My ultimate goal is to be financially free. I will give an update around every 3 months on how I’m getting on with my master plan of being financially free! Here’s how I’ve progressed over the past 3 months…

I wrote a post with my baseline for becoming financially free back in November 2018. As I mentioned in November, I calculated my financial freedom numbers by following the steps I outlined in my Freedom Plan posts one and two.

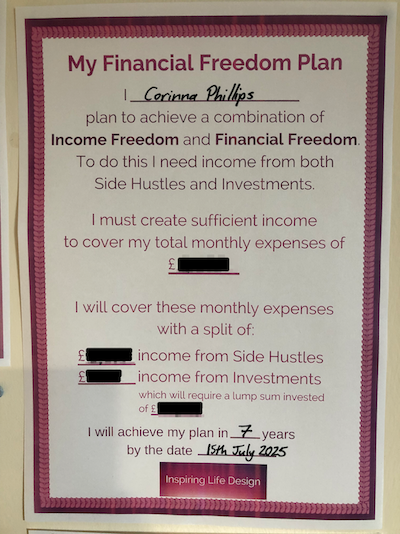

If you’d like to calculate what it would take for you to become financially free (the point where you have enough passive income to cover your expenses), I would highly recommend checking out those 2 posts. In part two you can also download a free Financial Freedom Plan printable, just like the one I keep on my office wall to remind me of my goal every day:

To become financially free I have a 2 pronged approach:

- Financial Freedom through investments: Saving and investing to build up a large investment pot

- Income Freedom through online business income: Creating my own small businesses (mostly online) to provide me with regular income. You can follow my progress to income freedom by reading my Income and Profit reports.

This post is providing an update for the first part of the above approach: Financial Freedom through investments.

Building Up My Investment Pot For Financial Freedom

I know exactly how much money I need to amass to cover all of my current expenses using the 4% safe withdrawal rate. I intend to build up an investment pot that will cover all of my expenses (even though I will be receiving money from my passive income side hustles). Why? Because I would like the security of having all of my expenses covered by investments, just in case my businesses stop generating me money.

Information I Share With You

I use percentages to update you on how I’m doing, rather than sharing the actual monetary amounts. The reason for this is that I’d like to keep some of my personal finances private. I really want to be able to document my progress toward being financially free, and share this with you in the hope that it might motivate you to do similar, using percentages seems like a good anonymised way of doing it.

To explain how this works, if we consider my ultimate financially free number (the amount which would allow me to never work again, by withdrawing up to 4% each year) to be 100%, then I can refer to the amount I currently have invested as a percentage of this. For example, if my financially free number was £100,000 and I currently had £20,000 invested, then I would be 20% of the way to achieving my goal.

What My Savings Are Invested In

When I talk about my existing investment pot, I can tell you that it is currently made up of a mix of the following:

- Pension

- Stocks & Shares ISAs

- Crypto currency investments (eeeek, perhaps that wasn’t the best decision I ever made!)

- Shares

The Three Different Ways I Track My Progress

There are 3 ways I am approaching becoming financially free:

- Through investments covering my expenses

- Through business income covering my expenses (ie income hustles)

- Through a combination of the above two

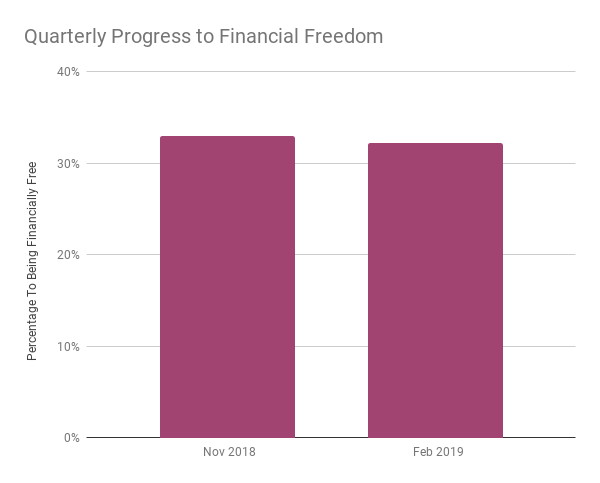

1. Progress To Being Financially Free Using Just My Investments

This is simply the percentage of my “financially free number” I currently have invested. This varies month to month based on the amount of savings I add to my investments and the latest valuation of my investments. Since I am invested in a range of funds, shares and gulp crypto currency (only a small amount) the value of my investment goes up and down.

If I were to write this out as an equation it would look like:

Investment Pot / Financially Free Number x 100

Result

As at February 2019 my investments totalled just over 32% of the goal I am striving to reach. In November my percentage was 33% so this has dropped slightly. The drop is not that surprising given how volatile the markets have been over the past couple of months. I also haven’t been adding any money to my ISA over the past 3 months, so the only investing has been through my pension.

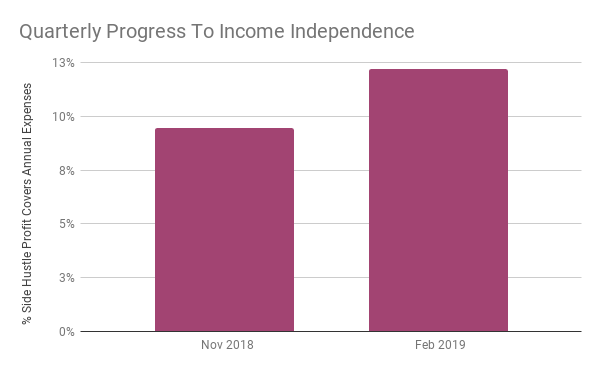

2. Progress To Income Independence Using Profit From My Businesses

This measure looks at the profit I’m making from my income hustles, as a proportion of the total annual expenses that I need to cover.

I calculate this by taking the average profit made over the past 12 months and multiplying this by 12 to get my annual profit. I then work out what percentage of my annual expenses my annual profit covers.

Putting this into an equation looks like this:

Annual Profit / Annual Expenses x 100

Where Annual Profit = average(last 12 month’s profit) x 12

NOTE: As my profit increases this calculation will eventually include tax and national insurance considerations, however at the current level this income would fall within the tax free/NI exempt brackets.

Result

As at the start of February 2019 my annual projected profit will cover just over 12% of my total annual expenses. This is up 3% from where I was in November 2018.

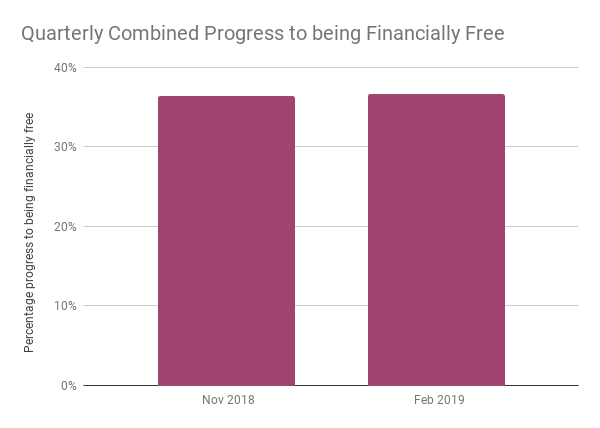

3. Progress To Becoming Financially Free Using Combined Approach

In my third calculation I track how close I am to being financially free using a combination of my current investments and profit from my income hustles.

To work this out, I subtract my annual profit from my annual expenses to get the annual amount I still need to cover using withdrawals from my investment pot. Then I multiply this amount by 25 to work out the total investment pot I need to amass to survive using the 4% withdrawal rule. Finally, I can use this figure to work out what percentage my current investment pot is.

In terms of equations this looks something like this:

Investment Pot / Adjusted Financially Free Number x 100

where Adjusted Financially Free Number is: (Annual Expenses - Annual Profit) x 25

Result

As at the start of February 2019 my progress to being financially free using this combined approach is 37%. This is a 1% improvement since I last reported in November 2018.

Changes from Baseline

So within the last 3 months things have moved slightly:

- Progress toward being financially free using investments alone: Dropped from 33% to 32%

- Progress toward freedom using income hustles: Increased from 9% to 12%

- Progress toward being financially free using both investments and profit from hustles: Increased from 36% to 37%

I’m pretty happy with this progress. I am hopeful over the next 3 months to see my income hustle progress increasing more rapidly. I don’t expect to see much change in my investment progress though because I’m not adding any money to my investments at the moment.

That’s it for this financially free update. If you have any questions about this side of my financial independence journey then do let me know in the comments below…

Join Corinna's newsletter!

Want to be first to hear about Corinna’s favourite finds?

All the freebies, offers and deals she finds get shared in her Newsletter. Want in? Sign up here…

Previous & Next Posts

In my PREVIOUS post I shared my income and profit results for January 2019.

My NEXT post offers an opportunity to enter the UK Money Bloggers Easter prize giveaway (now closed).