Creating a plan for Financial Freedom will significantly increase your chances of success in achieving your goal.

This is Part Two of a two part series discussing how to create your Freedom Plan. If you haven’t already read it, you should check out Part One first, in order to calculate your annual expenses.

Decide How You Plan To Cover Your Annual Expenses

The next part of creating your Freedom Plan is to decide how you intend to cover your expenses.

Cast your mind back to the two definitions in Part One:

Financial Freedom

I define financial freedom as having enough money to cover your expenses for life. The source of this money may be from savings, investments or passive income mechanisms. Once you are financially free you no longer need to work to earn money (though you can choose to continue to work if you want to).

Income Freedom

I define income freedom as the ability to generate sufficient money from independent business ventures, that it covers your expenses so that you do not have to work for anyone else. For example, someone who has built up enough regular income from their side hustles so that the money is sufficient to cover all their outgoings, would no longer need to work a regular day job. The side hustles become their new job!

As we decide how to cover our annual expenses we can look at these two different types of freedom and determine which suits us better, or even consider a combination of the two.

In essence we’re considering:

- Financial Freedom by savings, investments and passive income

- Income Freedom by generating money from independent business ventures

Let’s take a look at these in a bit more detail to understand how they could work for you.

1. Savings, Investments and Passive Income

Freedom via this route involves building up a nest egg of savings and investments with a view to covering your expenses using only the interest, therefore never depleting your funds. In theory you can do this indefinitely as long as you never withdraw more than 4% annually. There is a lot of debate in the FIRE (Financial Independence Retire Early) community around how realistic this is, with some suggesting that a withdrawal rate of 3% or 2% would be safer to ride out market dips or recessions.

I don’t intend to get into a safe withdrawal rate debate in this post, if you’re interested in learning more there are lots of sites who delve into this - simply search online for “safe withdrawal rate”.

For the purposes of this post I’m going to assume that it’s safe to use the 4% withdrawal rate.

Calculating your financial freedom number

If living off the interest of your investments sounds like a grand idea to you, here’s how you calculate the amount you need to have invested to sustain you:

TOTAL ANNUAL EXPENSES x 25 = Your Financial Freedom Number

So, if your Total Annual Expenses were £22,200 (as in the example in Part One) this would work out as:

£22,200 x 25 = £555,000

The amount you have here is your FINANCIAL FREEDOM NUMBER.

Woah - that’s a pretty big figure huh? The question is, how do you save this amount of money to enable you to become financially free? Unfortunately there is no quick and easy answer. Don’t despair though - this is where Inspiring Life Design comes in to help find the quickest and best route for YOU. As I mentioned earlier, seeking financial independence by investing is not the only way to secure your freedom.

There are lots of examples of people who have achieved financial freedom by building up an investment pot, many in their 30’s and 40’s. If you’re interested in reading more, there are some brilliant FIRE blogs that you can find on my blogroll documenting the journeys of people who have already become financially free, and those still working toward it.

How do you save such a large lump sum of money?

In a nutshell, the way to amass a sufficiently large amount of money to live off, boils down to:

- Reducing your expenses where possible

- Increasing the amount you save on a regular basis

- Investing your savings in stocks and shares so that your pot will have the best opportunity to grow (hint: low cost index funds are your friend)

- Allowing your pot to benefit from compound interest over time (ensure you reinvest any dividends and do not make any withdrawals)

You may already have some investments (for example in a pension) which will give you a head start to building up to your number. Pensions are great because they are usually a very tax efficient way to save. However don’t forget there are age restrictions on how soon you can start drawing from pensions, so if becoming financially free while younger is your goal, you should consider investing outside of your pension.

My personal view is that it’s best to spread your savings across different product types. For example, in the UK it’s a great idea to invest in a stocks and shares ISA because this allows tax free withdrawals when the time comes. Of course I’m no expert and am by no means qualified to offer advice for investing. You should always make decisions based on your personal circumstances, do your own research, and if in doubt seek assistance from an independent qualified financial advisor.

How long will it take to build up the amount needed?

This all depends on how much of your monthly income you currently save (ie your savings rate). Mr Money Mustache wrote a great post on this (check out the table showing how many years to retirement for different savings rates). The numbers are fascinating. If you are able to consistently save and invest 50% of your income you would be financially independent in 17 years. However, if you can increase this to 60% it’s just 12.5 years. Push yourself to an extreme saving rate such as 75% and you’re looking at being free in 7 years!

This is all well and good, but for most of us our savings rate is nowhere near these amounts. If you’re saving at all it may just be a small percentage into a company pension scheme, or putting aside what you can on the odd occasion. Even if you are saving 50% and up, it’s still a long road to travel to hit the sweet financial freedom number.

So is there another way?

Over the last year I’ve reached the conclusion that I want to be financially free sooner than my current savings rate will allow. I’m still saving and investing to ultimately be financially free using the 4% withdrawal rule, but I’m diversifying too.

My suggestion is you consider doing the same.

Break it down and think of everything in terms of income

Trying to achieve the massive investment needed to sustain you longer term feels like a pretty daunting, almost impossible job. However if you break this down into smaller goals this makes the task start to feel more achievable.

If you consider that for every £30,000 invested, this provides roughly £100 per month based on the 4% withdrawal rate. You can then start to set some milestones to make things feel more manageable:

| Amount Invested | Generates Monthly Income Of |

|---|---|

| £7,500 | £25 |

| £15,000 | £50 |

| £22,500 | £75 |

| £30,000 | £100 |

| £37,500 | £125 |

| £45,000 | £150 |

| £52,500 | £175 |

| £60,000 | £200 |

HANDY TIP: If you’d like to see a fuller table of investment amounts and the monthly income these should generate based on the 4% withdrawal rate you can visit this page.

HANDY TIP: If you’d like to see a fuller table of investment amounts and the monthly income these should generate based on the 4% withdrawal rate you can visit this page.

Start building up your investment pot as soon as you can, but break your large goal down into smaller targets, so that psychologically you know you are building up your income capability.

When you start thinking of your investments in terms of how much monthly income that means for you, it’s a small shift to take the next step and consider other ways you can diversify where your monthly income comes from. That leads me nicely into the second method for providing income:

2. Generating Money From Independent Business Ventures (i.e. Side Hustles)

When seeking Income Freedom all we’re trying to do is create sufficient income to cover our TOTAL MONTHLY EXPENSES (the amount that we calculated in Step 5 of Part One - £1,800 in the example used).

We do this by getting involved in a Side Hustle or two!

What’s a Side Hustle?

A Side Hustle is simply a term used to describe a way to make some extra cash, allowing you the flexibility to pursue what you’re most interested in. People often start out making money from their hobbies.

There are hundreds of different Side Hustle possibilities, made easier these days with all the various online opportunities. Some hustles are more time intensive than others, some may even offer the ultimate promise of passive income once they are up and running. I have already talked about My First 6 Money Makers, and I will be sharing more ways to start and grow your own side hustles.

Six Side Hustles To Get You Started

Here are a handful of Side Hustle opportunities you may want to consider:

- Book Publishing - this was my first side hustle and I still say this is a fantastic money generator due to the relative ease of entry and the passive income potential. I will be sharing more about book publishing in future posts.

- eBay Reselling - this is another side hustle with a low barrier of entry, and you can dip your toe in the water by selling personal items on eBay first to see if it’s for you. If you’re interested in giving reselling a try, I would highly recommend checking out this reselling page at Ruth Makes Money. You can also find some great tips in Ruth’s post on where she sources items to resell on eBay.

- Matched Betting - this is a way of making money by taking advantage of bookmaker offers. If you’re going to try this I would really recommend using OddsMonkey (affiliate link) to guide you through the money making offers. With a little bit of patience and a relatively small amount of money to get you started, you can begin earning using the tutorials and odds matching tool. There’s even a handy section to allow you to track your profits! You can start with a free membership which shows you how to earn up to £45, then if you like it you can sign-up for one of the packages.

- Survey Sites - this is a really quick and simple hustle to get into, great for earning a bit of cash in your quiet moments. Interested? Read all about my favourite survey site.

- Blogging - although this side hustle can take a little longer to see results, it’s a really fun and expressive way to make yourself additional money, and the income potential is huge. Plus what’s better than sitting back and making money from posts you wrote months ago?! If blogging sounds like your thing I can highly recommend Emma Drew’s Turn Your Dreams Into Money (affiliate link) course, where she shows you how to build a six-figure blog.

- Make Money From Your Hobby - there are many ways you can turn your hobby into a money making venture. There are side hustles for the green fingered, for the crafty and for those who love to shop to name but a few.

How Much Money Can I Make?

It’s almost impossible to say how much money you will make from the above side hustles. It’s a bit like asking “how long is a piece of string?”! As with most things in life, you will get out what you put in. The more time and effort you invest in a side hustle, the more financial rewards you will see.

If I were to very loosely rank the above side hustles in terms of earning potential (based purely on my opinion and current levels of knowledge/experience) I would say:

- Top earner = Book Publishing

- Blogging (though it can take time before you start earning anything)

- Matched Betting

- Ebay Reselling

- Surveys

Each person will have different strengths and preferences for side hustles, and therefore earning potentials could be vastly different.

Pulling Your Freedom Plan Together

So, you’ve calculated your annual expenses, and you’ve learnt about different methods to be able to cover those expenses. The final step is to decide how you plan to cover your annual expenses using one or several of these methods.

You may decide that you don’t have time or the inclination to get involved in any side hustles, but you are quite happy to start building a freedom investment fund to allow you to become financially free.

Or perhaps you feel that saving up money for financial freedom will take you too long, but you’d like to have a go at earning from side hustles to cover your annual expenses, allowing you to gain income freedom.

Of course if you’re like me, you may opt to do a combination of the two. I have decided to save as much as I can each year toward becoming financially free, but because at my current rate this is likely to take me over 10 years I’ve decided to pursue income freedom from side hustles to shorten my journey to freedom. Here’s an example of how this might look. If we use the total monthly expenses example of £1,850 from Part One, then a Combo Plan could break down something like this:

- Amount of monthly income from Side Hustles: £850

- Amount of monthly income from Investments: £1,000 (requiring a pot of £300,000)

- TOTAL MONTHLY INCOME ACHIEVED: £1,850

The question is, what percentage split would you go for? It’s ok to make a plan now, then adjust it in future as your savings rate and money earning potential becomes clear. The key thing is to create an initial plan now, then measure how you’re doing and adjust over time (perhaps annually or half yearly) to keep you on target.

How A Freedom Plan Might Look

Your Freedom Plan will most likely fall into one of the following three categories:

- Pure Financial Freedom

- Pure Income Freedom

- Financial Freedom and Income Freedom combo

I have created printable templates which you can download and fill out for each of these 3 plan types. All you need to do is decide which one works best for you, print it off, and fill in your information. Then put the plan on a wall somewhere you will see it daily to remind you of your intentions and the actions you need to take.

I have also created a spreadsheet to help determine how many years it will take to achieve Financial Freedom - this is useful for filling out Printables 1 & 3 below.

Here are the free printables for you to use:

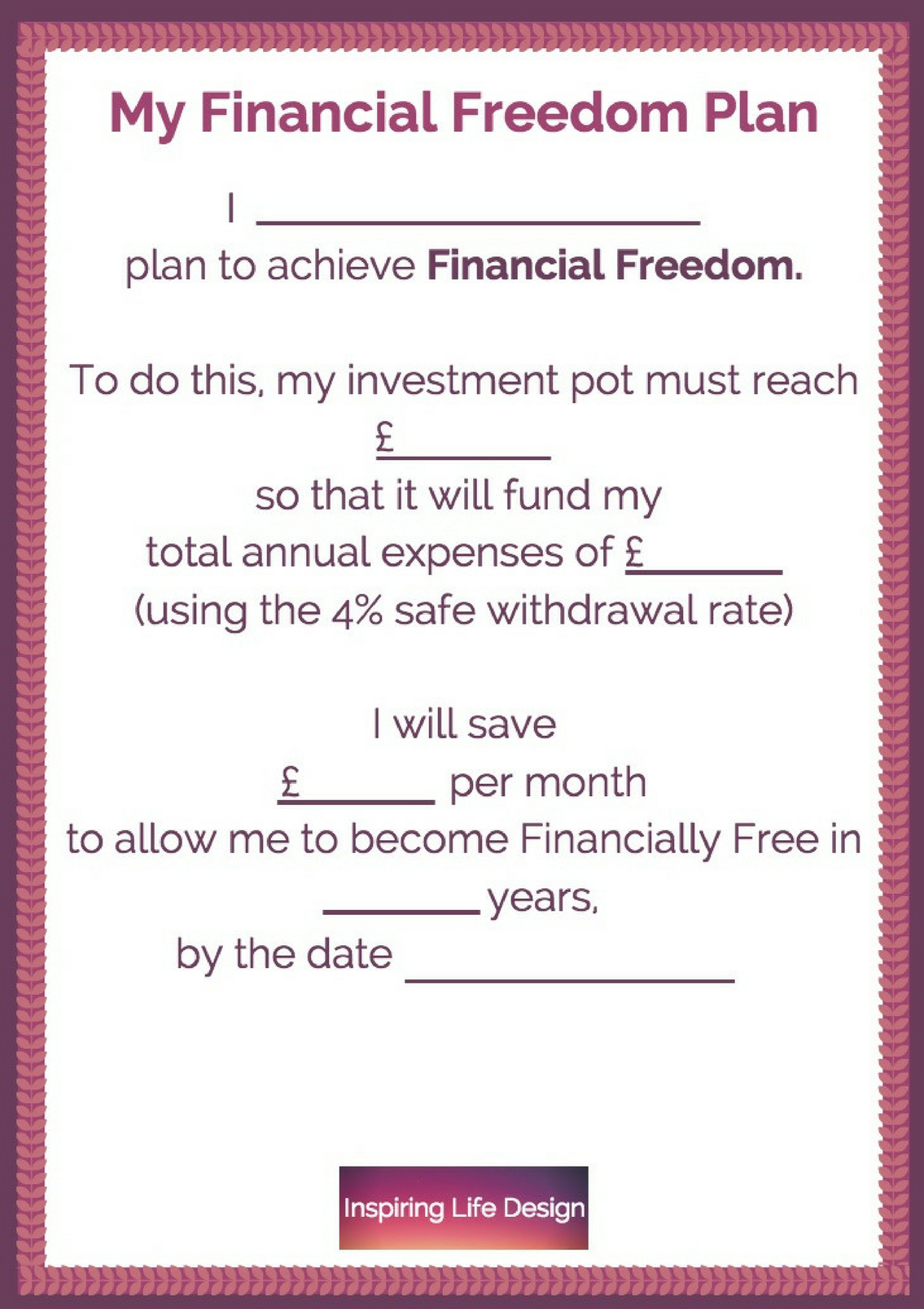

1. Pure Financial Freedom Plan

Fill in the sections of this printable as follows:

- Your name

- Your FINANCIAL FREEDOM NUMBER

- Your TOTAL ANNUAL EXPENSES (as calculated in Part One)

- The amount you intend to save each month

- The number of years you intend to save over to reach your goal

- The date by which you intend to reach your goal

Download: Pure Financial Freedom Plan Printable

Download: Pure Financial Freedom Plan Printable

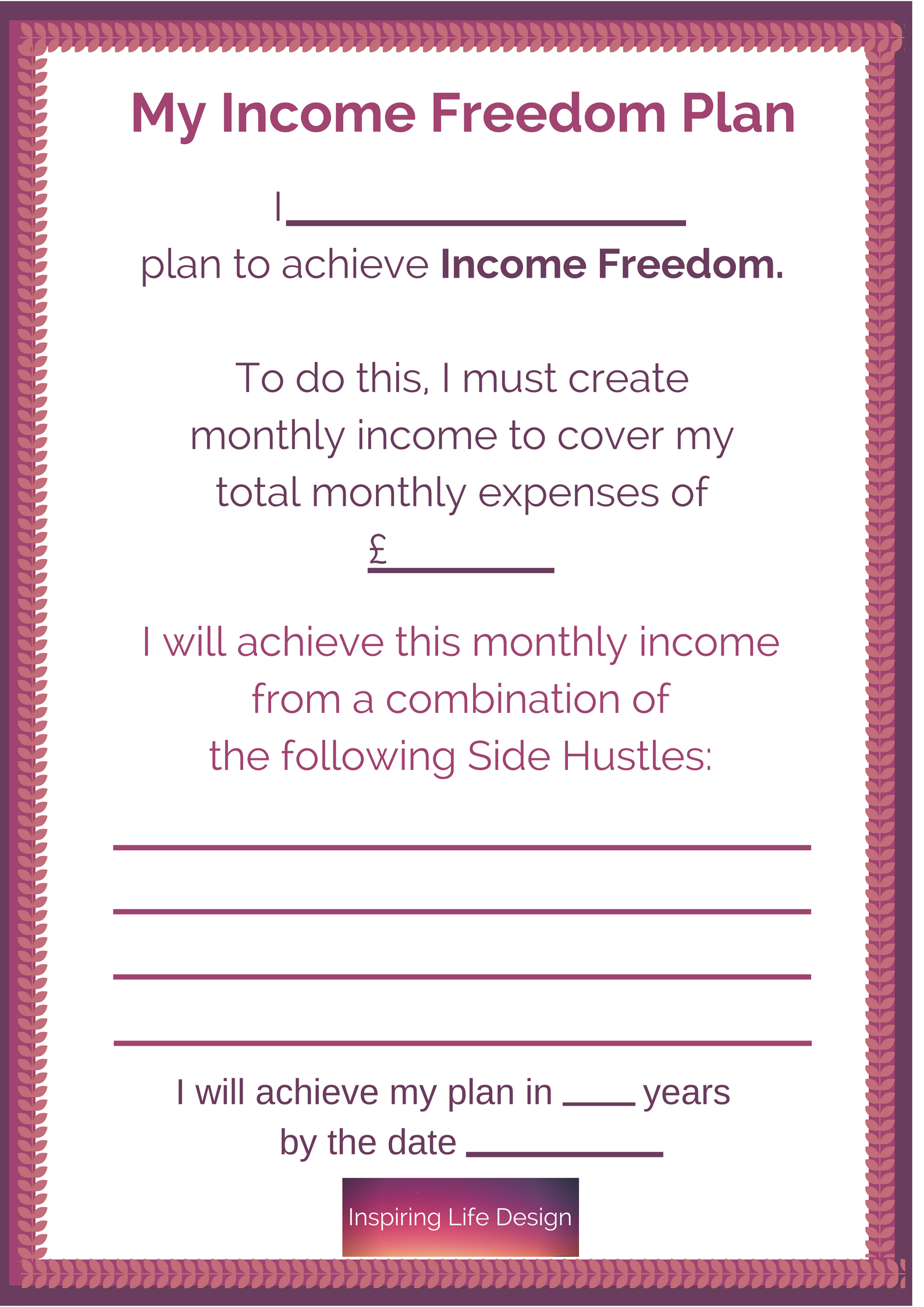

2. Pure Income Freedom Plan

Fill in the sections of this printable as follows:

- Your name

- Your TOTAL MONTHLY EXPENSES (as calculated in Part One)

- The Side Hustles you intend to use to generate income to cover your expenses

- The number of years you intend to achieve the plan in

- The date by which you intend to achieve the plan

Download: Pure Income Freedom Plan Printable

Download: Pure Income Freedom Plan Printable

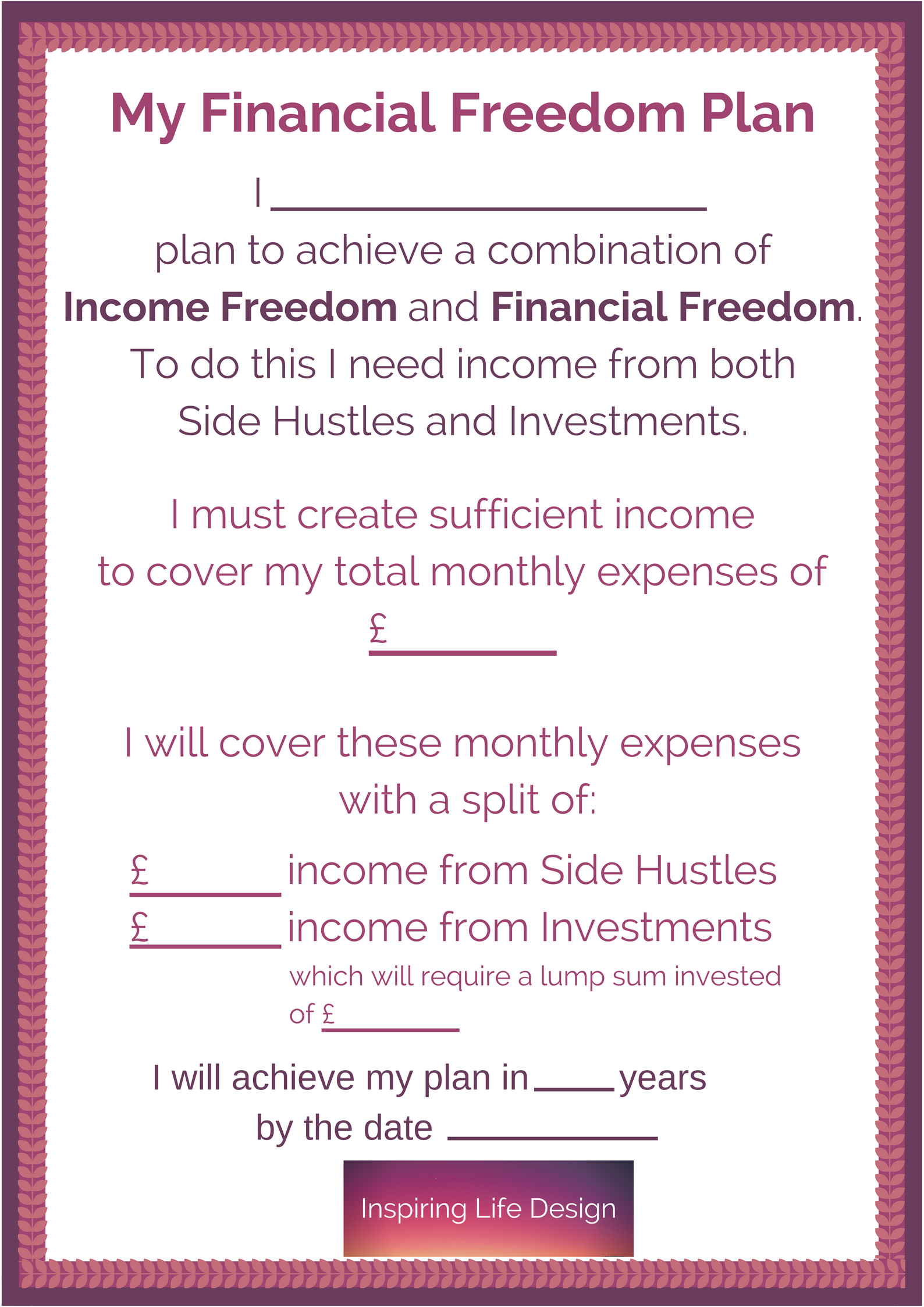

3. Financial Freedom and Income Freedom Combo

Fill in the sections of this printable as follows:

- Your name

- Your TOTAL MONTHLY EXPENSES (as calculated in Part One)

- The income you intend to generate from Side Hustles

- The income you intend to generate from Investments

- The amount of money you need invested to generate your required monthly amount from investments (see this page for the table to work this out)

- The number of years you intend to achieve the plan in

- The date by which you intend to achieve the plan

Download: Financial and Income Freedom Plan Combo Printable

Download: Financial and Income Freedom Plan Combo Printable

Over To You

Now you have all the information you need to create your first Freedom Plan. I’m sure you may have questions so please do ask these in the comments below and I will be sure to answer them as best I can.

Join Corinna's newsletter!

Want to be first to hear about Corinna’s favourite finds?

All the freebies, offers and deals she finds get shared in her Newsletter. Want in? Sign up here…

Previous & Next Posts

In my PREVIOUS post I talked about part one of creating your freedom plan.

In my NEXT post I provide an update on my February income & profit report.

I sometimes use affiliate links in my posts. This means that if you buy a service or product using my link I receive a small commission at no extra expense to you. You can navigate independently to the sites mentioned if you prefer not to use my affiliate links. I only link to products or services which I personally use & recommend.