My long-term goal is to be financially independent. Every year my annual goals are designed to move me toward this big target. It’s the reason I hustle to make money online and the reason why I started this website. So how is my progress going?

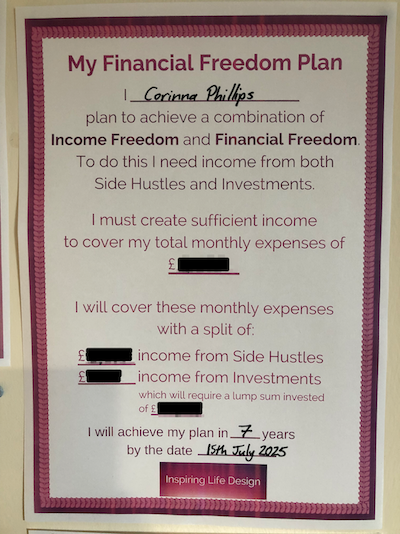

I have a Financial Freedom Plan printed out and stuck up on my office wall, to give me a daily reminder of my ultimate goal. I calculated my financial freedom numbers by following the steps I outlined in my Freedom Plan posts one and two, where you can also download your own free Financial Freedom Plan printable.

My plan to get me to financial freedom involves a combined approach of:

- Financial Freedom through investments: Saving and investing to build up a large investment pot

- Income Freedom through online business income: Creating my own small businesses (mostly online) to provide me with regular income

I have already been providing monthly updates on my progress toward Income Freedom, in my Income and Profit reports, however I haven’t spoken much about the other part of my plan, Financial Freedom through investments.

Building Up My Investment Pot For Financial Freedom

I have calculated how much money I need to amass to cover all of my current expenses using the 4% safe withdrawal rate. Even though I will be supplementing my income with profits from my online businesses, I still intend to ultimately build up an investment pot that will cover all of my expenses. Why? Because I would like the security that having all of my expenses covered by investments offers, just in case my businesses stop generating me money.

What I Will Be Sharing With You

The internet is a big and sometimes scary place. Information, once “out” in the net, is there for good. For this reason, I’m not ready at this time to share the specific monetary amounts of my FI target, or amounts invested. However, I would like to be able to discuss how I’m doing with regards to progress toward my FI goal. Therefore, I will be making use of percentages to share with you.

So if we consider my ultimate financial independence number (the amount which would allow me to never work again, by withdrawing up to 4% each year from it) to be 100%, then I can refer to the amount I currently have invested as a percentage of this. For example, if my financial independence number was £100,000 and I currently had £20,000 invested, then I would be 20% of the way to achieving my goal.

What My Savings Are Invested In

When I talk about my existing investment pot, I can tell you that it is currently made up of a mix of the following:

- Pension

- Stocks & Shares ISAs

- Crypto currency investments

- Shares

Three Different Ways To Track My Progress

In my Freedom Plan posts I suggested that there were 3 main ways to approach becoming financially independent:

- Through investments covering your expenses

- Through business income covering your expenses (ie income hustles)

- Through a combination of the above two

I am going to offer you an insight into how I’m getting on tracking against each of these 3.

1. Progress To Financial Independence Using Just My Investments

This is simply the percentage of my target financial freedom number I currently have invested. This varies month to month based on the amount of savings I add to my investments and the latest valuation of my investments. Since I am invested in a range of funds, shares and gulp crypto currency (only a small amount) the value of my investment goes up and down.

If I were to write this out as an equation it would look like:

Investment Pot / Financial Freedom Number x 100

Result

As at September 2018 my current investments total 33% of the goal I am striving to reach.

2. Progress To Income Independence Using Profit From My Businesses

This measure looks at the profit I’m making from my income hustles, as a proportion of the total annual expenses that I need to cover.

I calculate this by taking the average profit made over the past 12 months and multiplying this by 12 to get my annual profit. I then work out what percentage of my annual expenses my annual profit covers.

Putting this into an equation looks like this:

Annual Profit / Annual Expenses x 100

Where Annual Profit = average(last 12 month’s profit) x 12

NOTE: As my profit increases this calculation will eventually include tax and national insurance considerations, however at the current level this income would fall within the tax free/NI exempt brackets.

Result

As at September 2018 my annual projected profit will cover 9% of my total annual expenses.

3. Progress To Financial Freedom Using A Combined Approach

In this third calculation I’m tracking how close I am to being financially free using a combination of my current investments and profit from my income hustles.

To work this out, I’m subtracting my annual profit from my annual expenses to get the annual amount I still need to cover using withdrawals from my investment pot. Then I multiply this amount by 25 to work out the total investment pot I need to amass to survive using the 4% withdrawal rule. Finally, I can use this figure to work out what percentage my current investment pot is.

In terms of equations this would look something like this:

Investment Pot / Adjusted Financial Freedom Number x 100

where Adjusted Financial Freedom Number is: (Annual Expenses - Annual Profit) x 25

Result

As at September 2018 my progress to financial freedom using this combined approach is 36%.

Baseline

So there you have it. My baseline results are:

- Progress toward financial freedom using investments 33%

- Progress toward freedom using income hustles 9%

- Progress toward overall freedom using both investments and profit from hustles 36%

I’m a little surprised that the combined progress was only 3% more than investments alone. It’s an interesting calculation to do though, and it will be fun to track these three to see where I progress the most.

Hopefully the percentages I’ve shared about my progress to FIRE are interesting for you. If you have any questions about this side of my financial independence journey then do let me know in the comments below…

Join Corinna's newsletter!

Want to be first to hear about Corinna’s favourite finds?

All the freebies, offers and deals she finds get shared in her Newsletter. Want in? Sign up here…

Previous & Next Posts

In my PREVIOUS post I talked about How To Complete The Editing Of Your Ebook.

My NEXT post shares how I got on with my income hustle profits in October.