Now that we’re three weeks into the new year, it’s time to check in on #Challenge2018, where each participant has the target of saving £1,000 this year…

Recap - What’s It All About?

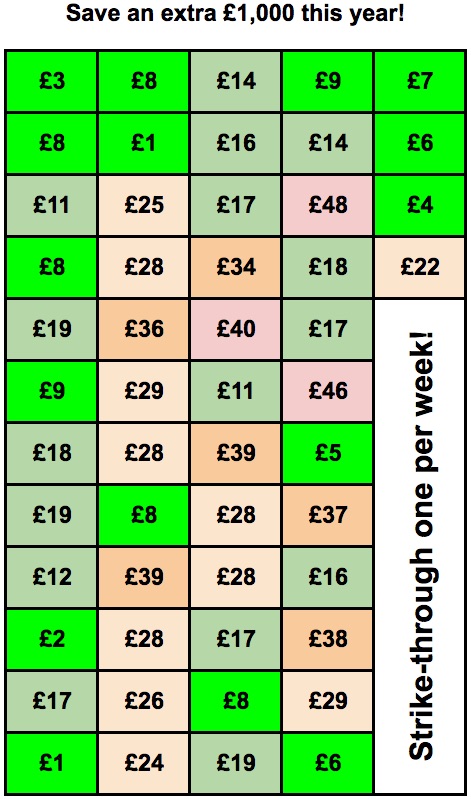

The beauty of this challenge is in its simplicity. I’ve created a chart for the challenge which has 52 boxes - one for each week of the year.

Inside each box is a monetary amount ranging from £1 to £48. Each week of the challenge all you must do is save the amount from one of the boxes, and then put a cross through the box. By the end of the year, all of the boxes will be crossed out and saved, amassing a whopping £1,000 for you to then spend as you please in 2019.

So How Can I Find £48 To Save In A Week?

It may feel a bit daunting finding a whole £48 to save in one week (with 3 further weeks still to save that month). Fear not! I have all the handy tips and tricks you will need to get you through.

But first, it’s important to understand the break-down of the 52 weekly amounts. I’ve split these into ranges below with the number of boxes that fall in that range:

| Monetary Range | Box Colour | Number of Boxes (Weeks) |

|---|---|---|

| £1 - £9 | Dark Green | 16 |

| £10 - £19 | Light Green | 16 |

| £20 - £29 | Beige | 11 |

| £30 - £39 | Orange | 6 |

| £40 - £48 | Pink | 3 |

As you can see, in the whole year there are only 3 weeks where an amount in the £40 range is needed and only 6 weeks in the £30-£39 range. For every week where you need to save an amount over £40, there are five weeks where you only need to save an amount between £1 - £9. What this means is that in some of the easier weeks, you can be looking ahead to when you want to hit a big week and plan for it.

For example, you may want to get your £48 box out of the way in the first week of a month, then in weeks 2, 3 and 4 of that month you may opt to save £1, £9 and £6 - which across the whole month is £64 in total. That’s just £2.15 a day, barely the cost of a cup of coffee!

With a bit of forward planning like in the example above, you could make each month’s savings goal easily achievable. It could be as easy as making your own hot drink to take with you from home each day, rather than hitting your local coffee shop. Or perhaps it might be taking a homemade lunch to work instead of buying out each day. Other ways of saving the money might be achieved by skipping one or two dinners out/takeaways, or having a good closet clearout to find those clothes you haven’t worn in years, rather than going for another clothes shop!

But I Hate Going Without!

That’s ok. You can set your mission to make the money you need each week. There are many ways to make money whether online or out in the real world! All it takes is a bit of time and effort once you know what your money making options are! That’s where InspiringLifeDesign comes in. My passion is finding and experimenting with new ways to make money, and I’m sharing all my learnings with you.

Week 3 Progress

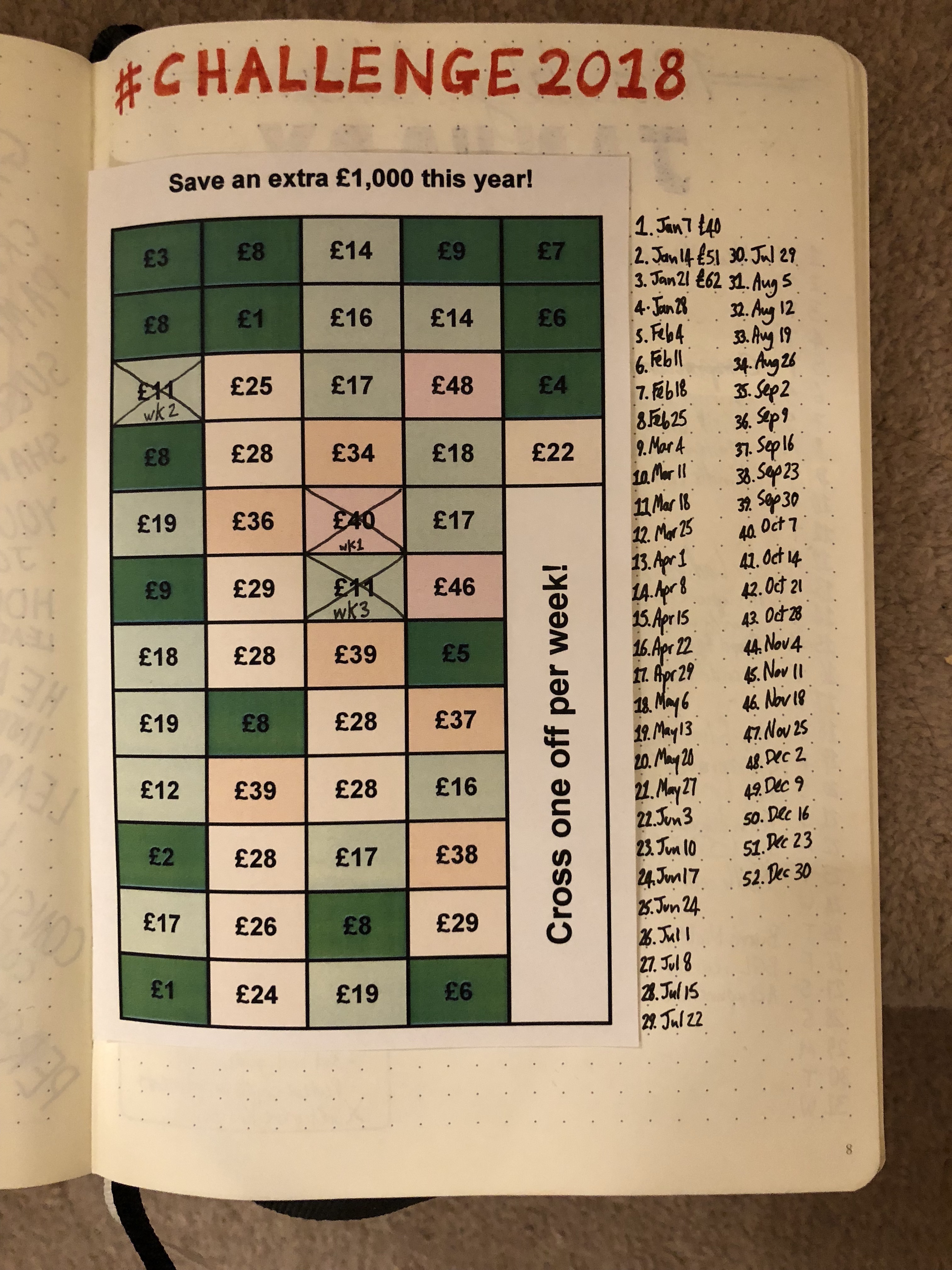

If you follow me on Instagram or Facebook, you’ll already know that I’ve been keeping everyone updated with how much I’ve been saving each week.

Here are my totals so far:

- Week 1: £40

- Week 2: £11

- Week 3: £11

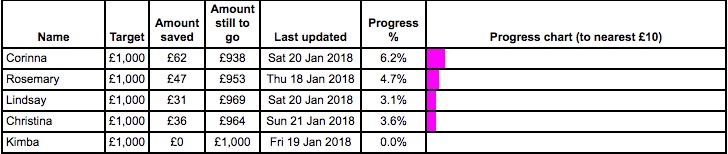

TOTAL: £62 (6.2% of goal achieved)

The Life Designers who’ve opted to join in on the #Challenge2018 page are doing fantastically well. With total savings at week 3 ranging from £31 to £47. Well done everyone - huge pats on the back all round.

A Novel Approach

One of the Life Designers contacted me this week about a brilliant approach she has thought of for joining in the challenge. Kimba has taken the 52 box chart and set-up a bank transfer every week for one of the amounts, into a saving account. This means that she won’t need to remember each week to set aside money, or worry about finding spare cash in her purse. She has basically guaranteed her success in the challenge! Read any of the big financial advice books on the market, and they’ll tell you that automating your finances plays a major role in success.

Well done Kimba! You’ve succeeded in inspiring me this week - perhaps even more Life Designers too when they read this!

Where To Keep Your Stash

For now, I’ve been saving the cash I’ve saved in an envelope in a safe storage space at home. However as the amount grows througout the year I think I’ll feel nervous about having that amount of money in the house. Looking ahead I’m planning to pay my savings into an old bank account of mine which I haven’t been using - it’s perfect for holding my £1,000 stash until I’m ready to spend or invest it next year. Once I have this account set up ready to hold my #Challenge2018 cash, it will actually make it easy for me to add to the fund electronically if I want to - making transfers from my main bank account, paying in more cash, or like Kimba setting up automated payments.

If you’re a Life Designer participating in the challenge, you may want to consider a savings account or bank account to deposit your savings into throughout the year to keep them safe.

Are you participating in #Challenge2018? Let me know how you’re choosing to store the money you’ve saved? A money box, envelope or bank account perhaps! Or maybe you have opted to do a different challenge altogether this year? I’d love to hear from you in the comments below…

Join Corinna's newsletter!

Want to be first to hear about Corinna’s favourite finds?

All the freebies, offers and deals she finds get shared in her Newsletter. Want in? Sign up here…

Previous & Next Posts

My PREVIOUS post was introducing the idea of the #Challenge2018 savings challenge.

In my NEXT post you can find out how I got on with my January 2018 income & profit.