In 2018 I set a challenge for myself and for anyone who wanted to join in, to save up £1,000. This was to be done by squirreling away differing amounts of money each month. Here’s how we got on.

Since this is my first post of 2019, I would like to take this opportunity to wish you all a very Happy New Year.

May this year hold everything that you wish for. In particular I hope that you make progress in whatever it is that you are striving for. I have often heard it said that the key to happiness is not in the actual achieving of a goal or long-held desire, but rather the journey to that destination.

Looking back on 2018 I am very happy with the progress that I made. It’s easy to look at the things which didn’t quite go to plan and feel frustrated about those, but it’s so important and gratifying to look at the wins from the year. Here’s just a few of my wins from 2018:

- Became more consistent with blogging (though there’s always room for improvement!)

- Grew my Instagram & Twitter accounts significantly

- Launched new books in Kindle and paperback format

- Took training in blogging and publishing

- Served as a Crew Member at Tony Robbins (affiliate link) Unleash The Power Within

- Attended the UK Money Bloggers event

- Enjoyed a fantastic holiday in Disneyland Paris

- Started a YouTube Channel channel

- Successfully saved up £1,000 in #Challenge2018

Today I’m reviewing #Challenge2018 and sharing with you what I learned from doing this savings challenge.

Background

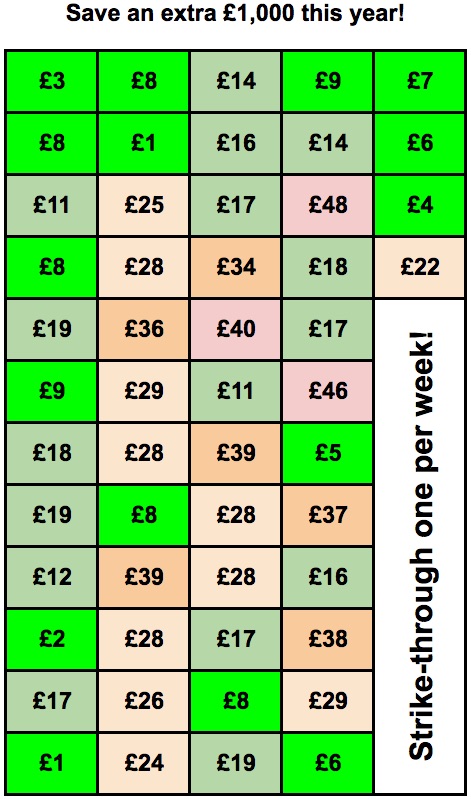

I first wrote about #Challenge2018 back in January last year, where I introduced the concept and reached out to anyone who wanted to join in. The idea was simple, each week we would put aside an amount of money that corresponded with one of the monetary amounts on the #Challenge2018 chart.

We would cross a box out each time we saved an amount. By the end of the year all 52 boxes were marked as done and we had £1,000 in our savings pots!

I maintained a special #Challenge2018 Tracking page so that we could easily see our progress alongside each other, which helped for motivation.

Celebrating

As Christmas rolled around each of the participants told me that they’d finished the challenge early! I can’t begin to tell you what an incredible feeling it was to know that I had £1,000 to spend on whatever I chose, but even better, that everyone else had successfully done it too!

I would like to extend my thanks and congratulations to Rosemary, Lindsay, Christina & Kimba who joined me on last year’s challenge. I had some lovely feedback…

Loved the challenge - as a group helps to keep the motivation going. Maybe if this is too long for people we could do a three month challenge.

Found putting more away Feb/Mar left me with the little amounts as we got closer to family birthdays and Christmas.

Looking to use this towards decorating our hallway and stairs.

What to spend it on

Throughout last year I had various different ideas for what I might use my money toward. I have to be honest and say that I still haven’t made a decision, but I thought it would be fun to share with you some of the possibilities:

- A Canon M50 camera so that I can improve my vlogging game

- A new iPad and Apple Pencil

- Put it toward a Tony Robbins’ Date With Destiny (affiliate link) ticket (would probably do the challenge again this year to get another £1,000)

- Put it toward another trip to Disneyland Paris (affiliate link)

- Add it to my emergency fund (feels like a slightly boring, but sensible option)

What about this year?

I have given quite a bit of thought over whether to run a similar challenge this year.

I found the challenge reasonably easy (some of the £30-£40 weeks were tougher) and fun to do. It felt satisfying every time I crossed off another amount from the chart. It was also lovely hearing from the others doing the challenge, knowing that they were saving every week too somehow made it easier for me to save.

However, there were several times when I didn’t have chance to update the tracking spreadsheet on a weekly basis. Time is increasingly an entity that I value more and more.

So I have decided to make a chart for a 2019 savings challenge and make this available to you. You can print it off (like I did last year - I kept it in my bullet journal) or update in a spreadsheet format.

However I’m not going to track everyone’s saving amounts each week on this website. I don’t think it’s necessary for the successful completion of the savings challenge.

I also found it quite fun to share my progress on other social media platforms such as Instagram and Twitter, which helped keep me accountable! If you do this, please be sure to tag me @inspiringlifedesign on Instagram.

Adding More Variations

Earlier this year I was chatting to someone on Instagram about the save £1,000 challenge, and they said that they thought it was too big a stretch for them to manage £1,000. Which gave me an idea.

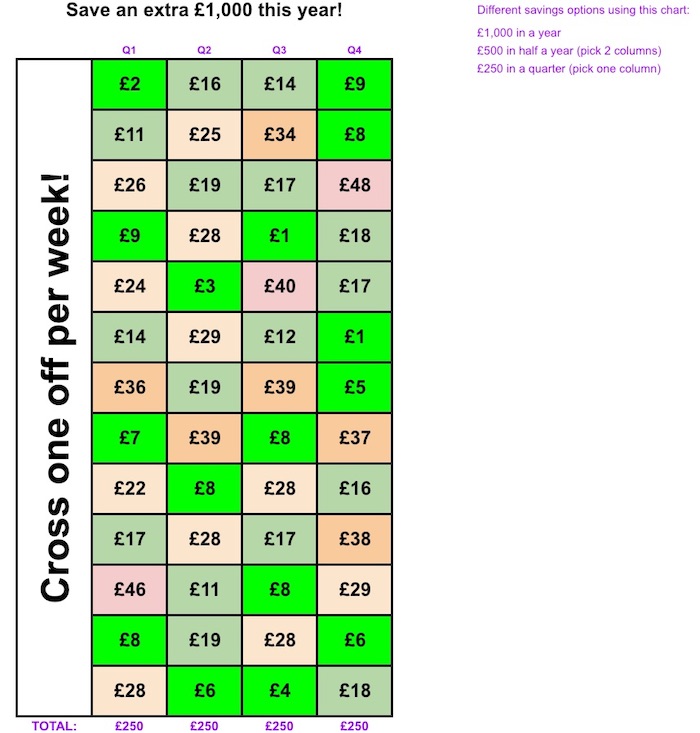

So I’ve now created charts for saving up £500 or £250 in a year.

For many people, particularly those in debt (or recently out of debt), saving up money may feel like wishful thinking. However, there’s a train of thought that advises on saving up an emergency fund before focusing on paying off debt. Something like this challenge can help to give your savings muscles a workout.

I’m a big believer in gamification, and although it’s very basic, I feel that this challenge turns the art of saving into a bit of a game. Surely that can only be a good thing!

I’ve also adjusted the charts so that they can be used for quarterly or half-yearly savings challenges instead. For example, looking at the £1,000 saving chart, you can also use this for a £500 half-yearly challenge or for a £250 quarterly challenge. This is possible by completing two or one of the 4 columns (each of which add up to £250).

Go on, have a go!

If you’d like to have a pot of money saved up by the end of 2019 why not give it a try?

There are a couple of ways the money can be saved. You can find somewhere safe and secure in your home and save cash (sweeping your purse or wallet at the beginning of a week is a nice approach for this).

Or you could open a current account (or similar) to save your money into. Last year I transferred my weekly amounts using online banking from my main account into the account I set up for the challenge. It’s sensible to keep a dedicated account just for your savings challenge, otherwise the saved money could get confused with other money.

This Year’s Charts

Simply use this link to my Google sheet (this is a web-based spreadsheet similar to Microsoft Excel for anyone unfamiliar with Google Sheets).

There are various tabs which you can choose from along the bottom. Each tab holds a different savings chart. Simply pick the savings challenge you want to set for yourself this year, then either print out the chart and keep it somewhere you’ll see it every week, or take a copy of the spreadsheet and update directly in there.

You will find the following tabs in this spreadsheet:

- Instructions

- Save £1,000 in a year

- Variations: Save £500 in half a year or save £250 in a quarter

- Save £500 in a year

- Variations: Save £250 in half a year or save £125 in a quarter

- Save £250 in a year

- Variations: Save £125 in half a year or save £62/£63 in a quarter

- Save $1,000 in a year

- Variations: Save $500 in half a year or save $250 in a quarter

- Save $500 in a year

- Variations: Save $250 in half a year or save $125 in a quarter

- Save $250 in a year

- Variations: Save $125 in half a year or save $62/$63 in a quarter

Hopefully there’s something for everyone there!

If you decide to do the challenge please let me know in the comments below. Also, what do you think I should put my £1,000 from last year toward?

Join Corinna's newsletter!

Want to be first to hear about Corinna’s favourite finds?

All the freebies, offers and deals she finds get shared in her Newsletter. Want in? Sign up here…

Previous & Next Posts

In my PREVIOUS post I shared the gifts I received in my 2018 homemade advent calendar

In my NEXT post I share my side hustle end of year income and profit position for 2018

I sometimes use affiliate links in my posts. This means that if you buy a service or product using my link I receive a small commission at no extra expense to you. You can navigate independently to the sites mentioned if you prefer not to use my affiliate links. I only link to products or services which I personally use & recommend.